I explained back in 2013 that there is a big difference between being pro-market and being pro-business.

Pro-market is a belief in genuine free enterprise, which means companies succeed or fail solely on the basis of whether they produce goods and services that consumers like.

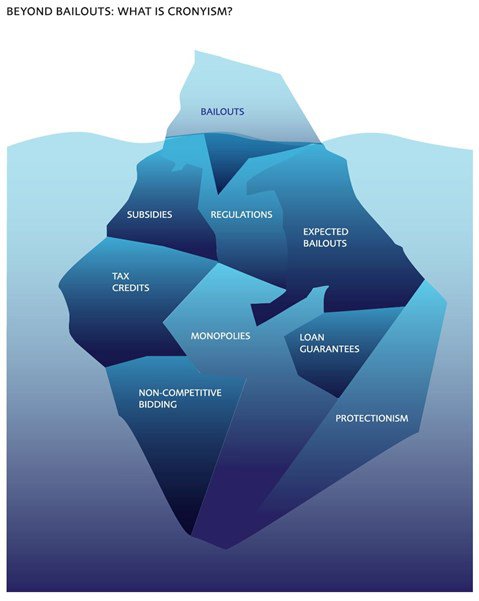

Pro-business, by contrast, is a concept that opens the door to inefficient and corrupt cronyism, such as bailouts and subsidies.

It basically means big business and big government get in bed together. And that’s going to mean bad news for taxpayers and consumers.

Washington specializes in this kind of cronyism. The Export-Import Bank, ethanol handouts, TARP, and Obamacare bailouts for big insurance firms are a few of my least-favorite examples.

But state politicians also like giving money to rich insiders.

State Governments Are Providing Incentives to Big Companies.

A report in the Washington Post reveals how states are engaged in a bidding war to attract Amazon’s big new facility, dubbed HQ2.

Maryland Gov. Larry Hogan (R) will offer more than $3 billion in tax breaks and grants and about $2 billion in transportation upgrades to persuade Amazon.com

to bring its second headquarters and up to 50,000 jobs to Montgomery County. …It appears to be the second-most generous set of inducements among the 20 locations on Amazon’s shortlist. Of the offerings whose details have become public, either through government or local media accounts, only New Jersey’s is larger, at $7 billion.

Richard Florida, a professor at the University of Toronto, explains to CNN why this approach is troubling.

…there’s one part of Amazon’s HQ2 competition that is deeply disturbing — pitting city against city in a wasteful and economically unproductive bidding war for tax and other incentives.

As one of the world’s most valuable companies, Amazon does not need — and should not be going after — taxpayer dollars… While Amazon may have the deck stacked in picking its HQ2 location, the mayors and elected leaders of these cities owe it to their tax payers and citizens to ensure they are not on the hook for hundreds of millions and in some cases as much as $7 billion in incentives to one of the world’s most valuable companies and richest men. …The truly progressive thing to do is to forge a pact to not give Amazon a penny in tax incentives or other handouts, thereby forcing the company to make its decision based on merit.

It’s not just a problem with Amazon.

Here’s are excerpts from a column in the L.A. Times on crony capitalism for Apple and other large firms.

State and local officials in Iowa have been working hard to rationalize their handout of more than $208 million in tax benefits to Apple, one of the world’s richest companies, for a data facility that will host 50 permanent jobs. …the Apple deal shows the shortcomings of all such corporate handouts, nationwide.

State and local governments seldom perform cost-benefit studies to determine their value — except in retrospect, when the money already has been paid out. They seldom explain why some industries should be favored over others — think about the film production incentives offered by Michigan, Louisiana, Georgia and, yes, Iowa, which never panned out as profit-makers for the states. …the handouts allow big companies to pit state against state and city against city in a competition that benefits corporate shareholders almost exclusively. Bizarrely, this process has been explicitly endorsed by Donald Trump. …politicians continue to shovel out the benefits, hoping to steer their economies in new directions and perhaps acquire a reputation for vision. Nevada was so eager to land a big battery factory from Tesla Motors’ Elon Musk that it offered him twice what Musk was seeking from the five states competing for the project. (In Las Vegas, this is known as “leaving money on the table.”) Wisconsin Gov. Scott Walker gave a big incentive deal to a furniture factory even though it was laying off half its workforce. He followed up last month with an astronomical $3 billion handout to electronics manufacturer Foxconn for a factory likely to employ a fraction of the workforce it forecasts.

And here’s an editorial from Wisconsin about a bit of cronyism from the land of cheese.

The Foxconn deal…should be opposed by Democrats and Republicans, liberals and conservatives. There are no partisan nor ideological “sides” in this debate. The division is between those who want to create jobs in a smart and responsible way that yields long-term benefits

and those who propose to throw money at corporations that play states and nations against one another. The Foxconn deal represents the worst form of crony capitalism — an agreement to transfer billions of dollars in taxpayer funds to a foreign corporation. …Walker offered the company a massive giveaway — discussions included a commitment to hand the Taiwanese corporation nearly $3 billion in taxpayer funds (if it meets hazy investment and employment goals), at least $150 million in sales tax exemptions…the Legislative Fiscal Bureau, which analyzes bills with budget implications…pointed out that Foxconn would receive at least $1.35 billion and possibly as much as $2.9 billion in tax incentive payments even if it didn’t owe any Wisconsin tax… This is a horrible deal.

Amazon Gets Priority with the Postal Service.

Let’s now circle back to Amazon and consider how it gets preferential treatment from the Post Office.

I don’t feel guilty ordering most of my family’s household goods on Amazon. …But when a mail truck pulls up filled to the top with Amazon boxes for my neighbors and me, I do feel some guilt. Like many close observers of the shipping business, I know a secret about the federal government’s relationship with Amazon: The U.S. Postal Service delivers the company’s boxes well below its own costs. Like an accelerant added to a fire, this subsidy is speeding up the collapse of traditional retailers in the U.S. and providing an unfair advantage for Amazon. …First-class mail effectively subsidizes the national network, and the packages get a free ride. An April analysis from Citigroup estimates that if costs were fairly allocated, on average parcels would cost $1.46 more to deliver. It is as if every Amazon box comes with a dollar or two stapled to the packing slip—a gift card from Uncle Sam. Amazon is big enough to take full advantage of “postal injection,” and that has tipped the scales in the internet giant’s favor. …around two-thirds of Amazon’s domestic deliveries are made by the Postal Service. It’s as if Amazon gets a subsidized space on every mail truck.

Privatization Is the Key to Removing Subsidies.

In this last example, the real problem is that we’ve fallen behind other nations and still have a government-run postal system.

The way to avoid perverse subsidies is privatization. That way, Amazon deliveries will be based on market prices and we won’t have to worry about a tilted playing field.

And that last point is critical.

Cronyism and Corporate Welfare Is an Economic Issue.

Yes, cronyism and corporate welfare are an economic issue. It is bad for long-run growth when political favors distort the allocation of capital.

But an unlevel playing field is also a moral issue. It simply isn’t fair nor right for politicians to give their buddies special advantages.

But an unlevel playing field is also a moral issue. It simply isn’t fair nor right for politicians to give their buddies special advantages.

And it’s both economically harmful and morally harmful to create a system where the business community views Washington as a handy source of unearned wealth.

For what it’s worth, I also think it should be a legal issue. For those of us who believe in the rule of law, a key principle is that everyone should be treated equally. Heck, that principle is enshrined in the Constitution.

So I’ve always wondered why courts haven’t rejected special deals for specific companies because of the equal-protection clause?

Then again, maybe I shouldn’t wonder. After all, the Supreme Court twisted itself into a pretzel to miraculously rationalize Obamacare.

But none of this changes the fact that it’s time to wean big business off corporate welfare.

P.S. Just in case you harbor unwarranted sympathy for big companies, remember that these are the folks who are often keen to undermine support for the entire capitalist system.

Reprinted from International Liberty.

Daniel J. Mitchell is a Washington-based economist who specializes in fiscal policy, particularly tax reform, international tax competition, and the economic burden of government spending. He also serves on the editorial board of the Cayman Financial Review.

This article was originally published on FEE.org. Read the original article.