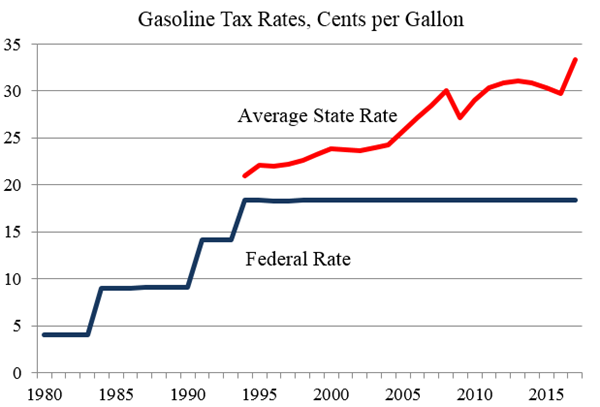

The federal government imposes a gasoline tax of 18.4 cents per gallon. Lobby groups are pressing for an increase, and President Trump has suggested he may support one. But a federal gas tax increase makes no sense.

State governments own America’s highways, and they are free to raise their own gas taxes whenever they want. Indeed, 19 states have raised their gas taxes just since 2015, showing the states are entirely capable of raising funds for their own transportation needs. State gas taxes average 34 cents per gallon.

State Gas Taxes As Revenue Generating Schemes

Also consider that gas taxes used to be a more pure user charge for highways, but these days gas tax money is diverted to inefficient nonhighway uses such as transit. Politicians say, “We need a gas tax increase to fix our crumbling highways,” and then they spend the money on other things. It is a bait-and-switch.

Federal fuel taxes and vehicle fees raise about $41 billion per year. About 20 percent of those funds (about $8 billion) are diverted to transit and other nonhighway uses.

The diversion is even larger with state fuel taxes, as shown in this Federal Highway Administration table. In 2016, state governments raised $44 billion from fuel taxes, and they diverted 24 percent—14 percent to transit and 10 percent to other activities. Texas, for example, diverts 25 percent of its fuel taxes to education spending.

Vehicle Fees Are Also Diverted

The states also raised $38 billion from vehicle fees. They diverted 34 percent of those funds—13 percent to transit and 21 percent to other activities.

In total, states raised $82 billion from fuel taxes and vehicle fees. They spent $59 billion (72 percent) on highways and $23 billion (28 percent) on other activities. If the highways in your state have congestion and potholes, it may because your government is taking money raised from highway users and diverting it to other activities.

The chart below shows the shares of state fuel taxes and vehicle fees diverted to nonhighway uses. South Carolina, for example, diverts 31 percent.

Last year, South Carolina Governor Henry McMaster vetoed a gas tax increase. He objected to his state’s diversion: “Over one-fourth of your gas-tax dollars are not used for road repairs … They’re siphoned off for government agency overhead and programs that have nothing to do with roads.”

As a rough user charge, gas taxes are a good way to fund highways, and our highways do need more investment. But motorists should be skeptical of gas tax increases until policymakers stop diverting funds to inefficient transit systems with declining riderships.

Many transportation experts say the rise of electric vehicles will be the end of the road for gas taxes, and they are eager to impose new vehicle miles traveled (VMT) charges to fund highways. However, governments are diverting more than $30 billion in fuel tax revenues and vehicle charges a year to nonhighway uses. If that diversion were ended, these revenues could continue to be America’s highway funding source for years to come.

More on highways and the gas tax:

https://www.downsizinggovernment.org/transportation/federal-highway-policies

https://www.downsizinggovernment.org/infrastructure-investment

https://www.downsizinggovernment.org/chamber-commerce-misguided-gas-tax

https://www.cato.org/blog/federal-gas-tax-increase-misguided

https://www.cato.org/blog/federal-gas-tax-lahood-makes-no-sense

Source: President Trump Reportedly Wants to Double the Federal Gas Tax – Foundation for Economic Education