The Thrilling and Sometimes Terrifying World of Crypto-Innovation Is at a Turning Point

It’s one thing to read about cryptoeconomics and another thing to actually do it. I had been reading about Bitcoin in the abstract from 2009, but it wasn’t until I became an owner in 2013 that I began to realize the implications of this technology.

My boots were on the ground, as they say, and I saw and experienced things I never imagined possible. A money and payment system in one application? Made entirely from code? Invented by an anonymous programmer and gradually adopted in a globally distributed system run by hobbyists? The whole thing seemed crazy.

I wanted to know more. So I organized one of the earliest national conferences on the topic in Atlanta, Georgia, in October 2013, when the Bitcon/dollar exchange ratio had reached $100 from $14 at the start of the year. My purpose was to bring economists and technicians together to develop a better understanding of what exactly was happening.

Last night, nearly four years later, I attended an exciting and passion-filled blockchain meetup in Atlanta. The Bitcoin price floats around $2,500, but this is off from a high that nearly touched $3,000. Many of the people who attended my first CryptoCurrency Conference were there again, but this time was different. Instead of being curious onlookers, many people in the room were part of what we might call the digital 1%: immense earnings based on speculative investments that paid off.

The New World

Now times are getting serious. The biggest banks and brokerage houses are on board. Tens of thousands of blockchain startups exist. There is a crowdfunding campaign for a new digital service and token nearly every day.

There are so many white papers being issued that no one can keep up. For all the world, it looks like Tulipmania except that this is what many people have claimed for eight years, during which time a new world has been born.

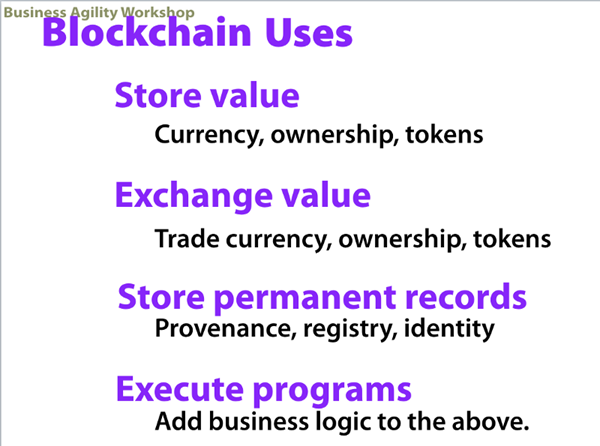

During Tulipmania, you were right to be suspicious because tulips had always been around. They didn’t represent anything new. The blockchain is something completely new: a new technology for porting adaptable information bits into immutable bundles to move cheaply and quickly across geographically non-contiguous lines.

With this new capability, spreading all over the world, a new class of geeks is leading a technological push to reconstruct the way we transmit money but also do contracts, property titles, and financial markets. All of this is based on a new way of commercial engagement, from dependency on intermediaries to working directly with each other.

Block Size

But merely to reflect on the amazingness of all this is not what drew the group together. The topic of the night is the pressing issue of the block size, a debate that has been rumbling around for a couple of years but which now cries out for resolution. The problem is that the blocks in the chain are currently limited to 1 megabyte, which is too small to hold all the transactions (and more complex forms of information) that the network is trying to push through. This is making the use of the network more expensive and slower than it should be. For some payment processors, it is becoming an impossible situation.

The core development team is famously conservative. In any case, merely busting the protocol with an arbitrary expansion is not a solution. What it needs is a long-term fix. Solutions were coming so slowly that a group of users acted to schedule the implementation of what amounts to a fork in the blockchain. (For more on the debate and the plan, and the difference between hard and soft forks, go here.)

Regardless, on August 1, something big is going to happen. It will be the biggest change to Bitcoin since its inception, with the purpose of making it scalable to compete directly with conventional payment processing.

The debate online can seem wickedly rhetorical, and forbidding to outsiders. For my own part, I’ve stayed out because I don’t have the level of technological knowledge sufficient to weigh in. Plus, having watched the community at work for years, I know by now that online sound and fury most often masks what is at the root a sober and prudent set of developers, miners, and users. Stephen Pair is most likely right: the great forking event will most likely be boring.

The Exciting Stuff

If this debate is too much – and only industry insiders are really thinking and writing about it – consider another level of complication.

Let’s talk about what used to be called alt-coins and the category of digital assets. (Incidentally, we are nearing the point where even the world alt-coin is deprecated. We now call them what they are: Litecoin, Dash, Dogecoin, and so on.)

When I held my conference, there were a few additional coins floating around out there. Hardly anyone thought they were viable. Back then, Bitcoin was amazing when it passed the $10 mark. Today, there are 12 additional coins that float above $10, and three of those have market capitalizations above $1 billion.

Here’s another interesting change: there are fully 18 digital assets that trade above $10. And 10 of these assets have market capitalizations above $1 billion. Most are based on Ethereum, which is a platform for the development of a new class of services running blockchain technology. At the time it was first described, it seems visionary but outlandish. A few years later, it is a reality in the making.

I’ve been slow to get involved in the asset market, but just yesterday tried my hand at moving tokens around in the space. I can’t begin to describe to you the complications. This is not for mere mortals. As I performed the task of moving from one asset to another, switching platforms and watching for confirmations and thresholds, I felt that same sense of awe I had when I first received and sent bitcoins. If possible, it was actually more difficult.

Why Is this So Hard?

There are two factors here. First, this is nowhere near ready for the mainstream consumer marketplace. For anyone but full-time code slingers, this feels like rocket science. Second, everywhere you move, you bump into evidence of government regulation of exchanges, dating from that fateful day in the spring of 2013 when the Department of Treasury decided to effectively shut down an entire class of entrepreneurial ventures.

It’s hard enough to reinvent the infrastructure of the global exchange economy. It is too much to attempt this feat in the face of regulators who have no clue whatsoever about the structure and technology we are dealing with here. Governments are trying to retrofit a disruptive technology by trying to make them behave like the old forms they are trying to replace.

All of this is enormously annoying. But let me say this: it is temporary. They can slow us down but they can’t stop us. You could feel it in the energetic meetup last night. These people are smart, dedicated, and they see the future. They won’t be stopped. More than that, because they are all owners and stakeholders in this new digital space, they have the passion to follow through.

The sad fate of revolutionary technology like this is that it doesn’t gain popular enthusiasm until it is used by the average person. Even then, the period of awe only lasts a brief time until we just assume that the world was destined to work this way. It’s this way with map apps, email, electricity, flight, steel, soap, eyeglasses, or any other invention.

Here’s to the innovators and entrepreneurs who just keep making the world better despite every barrier and despite the absence of public acclaim they so richly deserve.

Jeffrey Tucker is Director of Content for the Foundation for Economic Education. He is also Chief Liberty Officer and founder of Liberty.me, Distinguished Honorary Member of Mises Brazil, research fellow at the Acton Institute, policy adviser of the Heartland Institute, founder of the CryptoCurrency Conference, member of the editorial board of the Molinari Review, an advisor to the blockchain application builder Factom, and author of five books. He has written 150 introductions to books and many thousands of articles appearing in the scholarly and popular press.

This article was originally published on FEE.org. Read the original article.