President Joe Biden introduced new provisions to his student debt relief plan earlier this month, and the primary beneficiaries are high-income earners, according to a new analysis released by the Wharton School of the University of Pennsylvania.

While Biden’s 2023 SAVE Plan already put taxpayers on the hook for $475 billion, the new plans add another $84 billion to the tally — largely by “canceling” the student debt of some 750,000 households making more than $312,000 a year on average.

The average debt relief for these households is $25,500, the study found.

In June 2023, the Supreme Court struck down the Biden administration’s previous loan forgiveness program, which was implemented without congressional approval. And like Biden’s previous attempt to stick taxpayers with hundreds of billions of dollars of student loans via executive action, the latest attempts have sparked numerous lawsuits and appear headed for a legal showdown.

“This latest attempt to sidestep the Constitution is only the most recent instance in a long but troubling pattern of the President relying on innocuous language from decades-old statutes to impose drastic, costly policy changes on the American people without their consent,” one of the lawsuits reads.

Whether the White House’s latest scheme fares any better in court than the previous one is yet to be determined. What’s clear is that it is a dreadful, immoral, and dangerous policy.

For starters, the public treasury is being used to pay off the student loans of families who represent the top 5% of earners in the United States. This would be an unjust, senseless, and reckless policy even in fat economic times. But the times are hardly fat.

The national debt stands at nearly $35 trillion right now, and payments to service that debt are surging at a historic rate. Meanwhile, inflation in the U.S. remains stubbornly high. Consumer prices were up nearly 4% year-over-year in February, nearly double the Federal Reserve’s 2% target.

Biden’s student loan forgiveness scheme is likely to goose consumer spending, which economists say will make inflation even worse.

“I think there’s real concern among economists in that [debt forgiveness] is just going to create more of an inflationary problem,” University of Cincinnati economist Michael Jones told Cincinnati Edition, an NPR affiliate, last year.

Higher inflation and more debt are not the only consequences of debt forgiveness.

The Bennett Hypothesis, named after former Education Secretary William J. Bennett, states that one of the reasons tuition is so high in the first place is the steady flood of federal dollars for college-bound students, which allows universities to jack prices higher and higher.

An abundance of peer-reviewed economic research supports this thesis, including a study conducted by the Federal Reserve Bank of New York that found colleges hiked tuition by 60 cents for each dollar of federal aid doled out. Loan forgiveness is likely to have a similar effect.

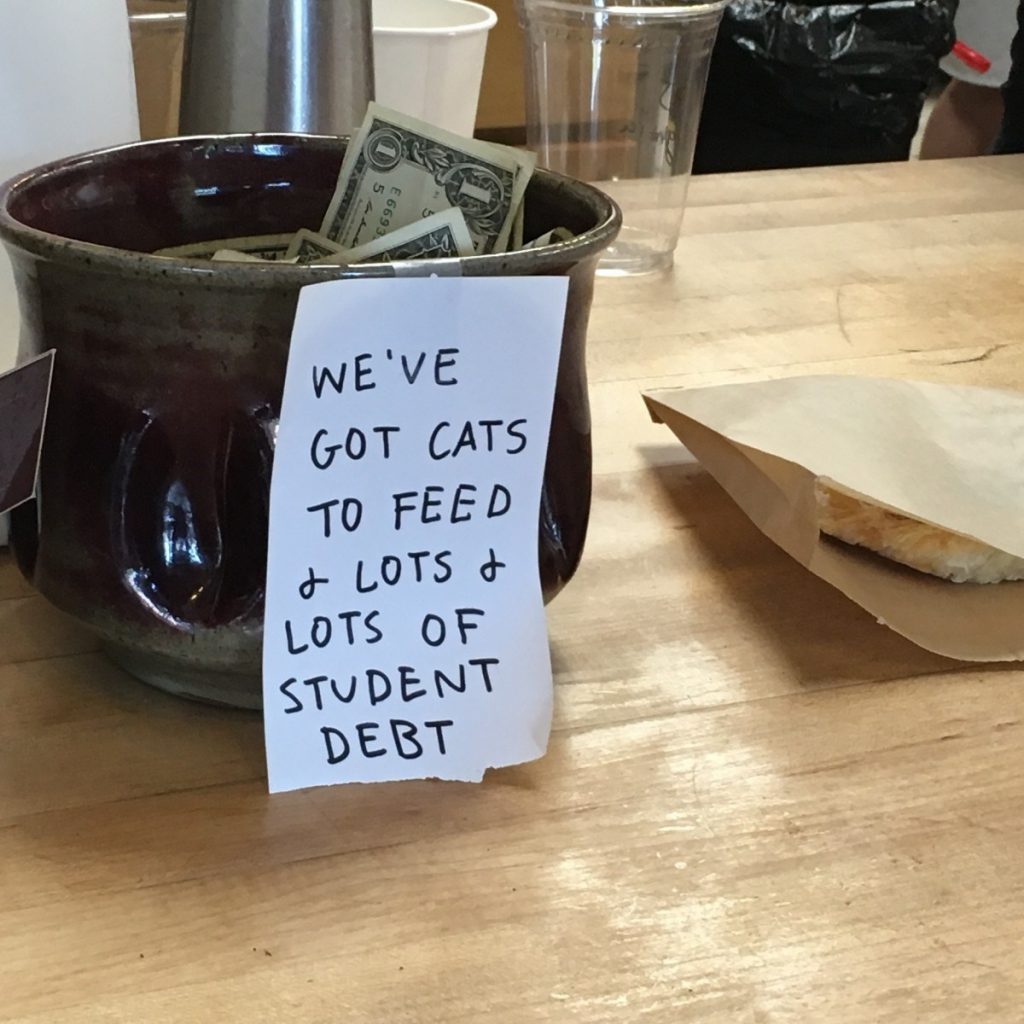

All of these examples illustrate what we already know. Waving a wand to strike the outstanding $250,000 loan of the musician who wants to take a sabbatical to India to meditate isn’t consequence-free. It comes with economic trade-offs, just like everything else.

And loan forgiveness shouldn’t be confused with charity. In fact, making taxpayers pay back loans they never took out is nothing short of legalized plunder.

The 19th-century economist Frederic Bastiat wrote at length about legalized plunder, and he reminded us that there are just two ways that wealth is acquired. One way is through voluntary exchange and individual activity. The other is through theft and coercion.

Voluntary is a key word here. A philosopher no less renowned than Aristotle observed that for an act to be virtuous, it must be voluntary. This is why freely paying off your nephew’s student loan with your own money is a virtuous act of charity, while using money taken from your neighbors under duress is not.

Despite those letters sent to debt relief recipients that read, “Congratulations! The Biden-Harris Administration has forgiven your federal student loan(s),” loan forgiveness is not an act of charity. Nor is it sound policy.

Yet Bastiat likely would not have been surprised to see U.S. presidents taking credit for using the public treasury, funds obtained from the people under the threat of government force, to cover the loans of wealthy, highly educated families with vast earning power.

“When plunder becomes a way of life for a group of men in a society,” he wrote in Economic Sophisms, “over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.”https://www.youtube.com/embed/aro6vBg1y1s?feature=oembed

This article originally appeared in The Washington Examiner.