Seattle’s $15 Minimum Wage Experiment Does Not Bode Well for the Rest of Us

Two weeks. Two studies on minimum wage. Two very different results. Last week, a report out of the University of California – Berkeley found “Seattle’s minimum wage ordinance has raised wages for low-paid workers, without negatively affecting employment,” in the words of the Mayor’s Office. That report, produced by the Center on Wage and Employment Dynamics at Berkeley, was picked up far and wide as proof that the doomsday scenarios predicted by skeptics of the plan were failing to materialize.

And while another study that came out Monday from researchers at the University of Washington (UW) doesn’t exactly spell doomsday either, it wasn’t exactly rosy. “UW study finds Seattle’s minimum wage is costing jobs,” read the Seattle Times headline Monday morning. The study found that while wages for low-earners rose by 3 percent since the law went into effect, hours for those works dropped by 9 percent. The average worker making less than $19 an hour in Seattle has seen a total loss of $125 a month since the law went into effect.

There’s an old joke that economics is the only field where two people can win the Nobel Prize for saying the exact opposite thing. However, by all appearances, these two takeaways on Seattle’s historic minimum wage law are not a symptom of the vagaries of a social science but an object lesson in how quickly data can get weaponized in political debates like Seattle’s minimum wage fight. In short, the Mayor’s Office knew the unflattering UW report was coming out and reached out to other researchers to kick the tires on what threatened to be a damaging report to a central achievement of Ed Murray’s tenure as mayor.

And here’s the key takeaway of what Person uncovered:

To review, the timeline seems to have gone like this: The UW shares with City Hall an early draft of its study showing the minimum wage law is hurting the workers it was meant to help; the mayor’s office shares the study with researchers known to be sympathetic toward minimum wage laws, asking for feedback; those researchers release a report that’s high on Seattle’s minimum wage law just a week before the negative report comes out.

In other words, if you don’t like an unflattering study from a team of researchers from the local university that accurately exposes some of the negative employment effects of the city of Seattle’s $15 minimum wage, you shop around – out of state in this case — for a more favorable study of that questionable and risky public policy experiment.

And what didn’t the Seattle mayor’s office like about the UW study? Let’s find out by looking at some of the key findings of the 63-page NBER study “Minimum Wage Increases, Wages, and Low-Wage Employment: Evidence from Seattle” by Ekaterina Jardim, Mark C. Long, Robert Plotnick, Emma van Inwegen, Jacob Vigdor and Hilary Wething (all six are professors in the Daniel J. Evans School of Public Policy and Governance at the University of Washington). The selected excerpts below help tell the story that the city of Seattle didn’t want to hear (emphasis added):

Abstract:

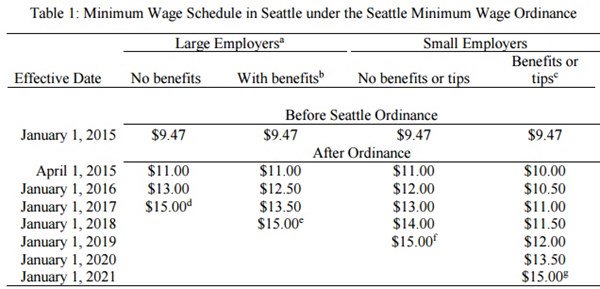

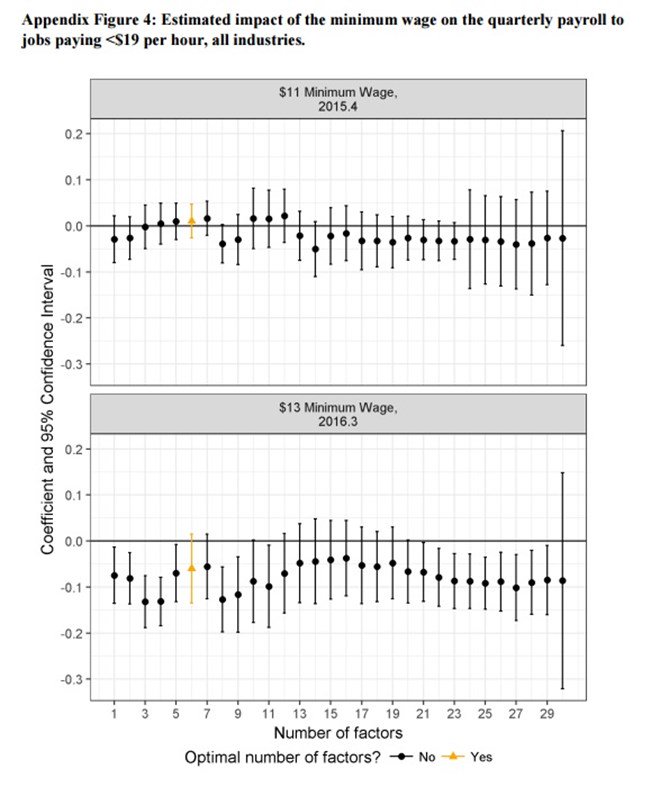

This paper evaluates the wage, employment, and hours effects of the first and second phase-in of the Seattle Minimum Wage Ordinance, which raised the minimum wage from $9.47 to $11 per hour in 2015 and to $13 per hour in 2016. Using a variety of methods to analyze employment in all sectors paying below a specified real hourly rate, we conclude that the second wage increase to $13 reduced hours worked in low-wage jobs by around 9 percent, while hourly wages in such jobs increased by around 3 percent. Consequently, total payroll fell for such jobs, implying that the minimum wage ordinance lowered low-wage employees’ earnings by an average of $125 per month in 2016.

Conclusion:

Our preferred estimates suggest that the Seattle Minimum Wage Ordinance caused hours worked by low-skilled workers (i.e., those earning under $19 per hour) to fall by 9.4% during the three quarters when the minimum wage was $13 per hour, resulting in a loss of 3.5 million hours worked per calendar quarter. Alternative estimates show the number of low-wage jobs declined by 6.8%, which represents a loss of more than 5,000 jobs. These estimates are robust to cutoffs other than $19. A 3.1% increase in wages in jobs that paid less than $19 coupled with a 9.4% loss in hours yields a labor demand elasticity of roughly -3.0, and this large elasticity estimate is robust to other cutoffs.

These results suggest a fundamental rethinking of the nature of low-wage work. Prior elasticity estimates in the range from zero to -0.2 suggest there are few suitable substitutes for low-wage employees, that firms faced with labor cost increases have little option but to raise their wage bill. Seattle data show that payroll expenses on workers earning under $19 per hour either rose minimally or fell as the minimum wage increased from $9.47 to $13 in just over nine months. An elasticity of -3.0 suggests that low-wage labor is a more substitutable, expendable factor of production. The work of least-paid workers might be performed more efficiently by more skilled and experienced workers commanding a substantially higher wage. This work could, in some circumstances, be automated. In other circumstances, employers may conclude that the work of least-paid workers need not be done at all.

Importantly, the lost income associated with the hours reductions exceeds the gain associated with the net wage increase of 3.1%. Using data in Table 3, we compute that the average low-wage employee was paid $1,897 per month. The reduction in hours would cost the average employee $179 per month, while the wage increase would recoup only $54 of this loss, leaving a net loss of $125 per month (6.6%), which is sizable for a low-wage worker.

Here’s one thing the UW study didn’t consider yet, because it’s too early: The additional $2 an hour increase in the city’s minimum wage that just took effect on January 1 of this year from $13 to $15 an hour for large employers. Once local employers feel the full effect of the 58% increase in labor costs for minimum wage workers from $9.47 to $15 an hour in less than two years, it’s likely the negative employment effects uncovered by the UW team for 2016 will continue this year and into the future, and could likely increase.

Here’s some additional commentary on the developing Seattle minimum wage story:

1. The Seattle Times Editorial Board warns that “Seattle should open its eyes to minimum-wage research.”

Murray’s office said it had concerns about the “methodology” of the UW study. But the strategy is clear and galling: celebrate the research that fits your political agenda, and tear down the research that doesn’t.

The minimum-wage experiment sweeping the country needs good, thorough, independent research. Seattle led this movement, passing the highest local minimum wage in the country. Does City Hall really want to know the consequences, or does it want to put blinders on and pat itself on the back?

2. Forbes contributor Tim Worstall writes today that “As I Predicted, Seattle’s Minimum Wage Rise Is Reducing Employment.”

3. Max writes in today’s Washington Post that “A ‘very credible’ new study on Seattle’s $15 minimum wage has bad news for liberals.”

4. Ben Casselman and Kathryn Casteel express their concerns in FiveThirtyEight that “Seattle’s Minimum Wage Hike May Have Gone Too Far.” Here’s a slice:

In January 2016, Seattle’s minimum wage jumped from $11 an hour to $13 for large employers, the second big increase in less than a year. New research released Monday by a team of economists at the University of Washington suggests the wage hike may have come at a significant cost: The increase led to steep declines in employment for low-wage workers, and a drop in hours for those who kept their jobs. Crucially, the negative impact of lost jobs and hours more than offset the benefits of higher wages — on average, low-wage workers earned $125 per month less because of the higher wage, a small but significant decline.

“The goal of this policy was to deliver higher incomes to people who were struggling to make ends meet in the city,” said Jacob Vigdor, a University of Washington economist who was one of the study’s authors. “You’ve got to watch out because at some point you run the risk of harming the people you set out to help.”

“This is a ‘canary in the coal mine’ moment,” said David Autor, an MIT economist who wasn’t involved in the Seattle research. Autor noted that high-cost cities such as Seattle are the places that should be in the best position to absorb the impact of a high minimum wage. So if the policy is hurting workers there — and Autor stressed that the Washington report is just one study — that could signal trouble as the recent wage hikes take effect in lower-cost parts of the country.

“Nobody in their right mind would say that raising the minimum wage to $25 an hour would have no effect on employment,” Autor said. “The question is where is the point where it becomes relevant. And apparently in Seattle, it’s around $13.”

Bottom Line:

If booming, high cost-of-living Seattle had a hard time absorbing a $13 an hour minimum wage last year without experiencing negative employment effects (reduced hours, jobs and earnings for low-wage workers), it will have an even more difficult time dealing with the additional $2 an hour increase that took place on January 1 without even greater negative consequences. And if Seattle’s risky experiment with a $15 an hour minimum wage represents the “canary in the coal mine” for cities around the country that want to increase their minimum wages to $15 an hour, those cities may want to hold off for a few years to get a final count of the “dead canaries” in Seattle before proceeding.

Reprinted from AEI.

Mark J. Perry is a scholar at the American Enterprise Institute and a professor of economics and finance at the University of Michigan’s Flint campus.

This article was originally published on FEE.org. Read the original article.

and this is okay if policy is based on some notion of greatest good for the greatest number. In other words, you can’t make an omelet without breaking a few eggs.

and this is okay if policy is based on some notion of greatest good for the greatest number. In other words, you can’t make an omelet without breaking a few eggs.