The oldest trick in the monetary book is cheating the people by debasing the coin or currency. It goes back at least as far as the Eighth Century B.C. when the Jewish prophet Isaiah chastised the Israelites for doing it. “Thy silver has become dross, thy wine mixed with water!” he admonished.

Reputable private issuers of money, when governments don’t ban them for self-serving reasons, might be tempted to dilute the value of their product. Their incentives, however, tend to run strongly in the other direction.

If their product gains in value, they make money (literally and figuratively). If they debase it, they might be prosecuted for counterfeiting or fraud. But in any event, customers will flee to competitors happy to “make money” by offering it in a more trustworthy form.

When entrepreneurs and willing customers shape the framework of a market, the famous Gresham’s Law works in reverse: the good money drives out the bad.

Similarly, because you prefer fresh eggs to expired ones, or use an iPhone now instead of a walkie-talkie, the inferior product disappears. But when political monopolists backed by the coercive power of government are in charge, the quantitatively-eased stuff is foisted on you whether you like it or not, while the good alternatives are driven overseas or underground.

Kipper and Wipper

I thought I knew the low points in the interesting history of monetary corruption until I came across this fascinating article from Smithsonian magazine. It’s about a brief hyperinflation in 17th Century Europe at the start of the Thirty Years’ War.

Titled “Kipper und Wipper”: Rogue Traders, Rogue Princes, Rogue Bishops and the German Financial Meltdown of 1621-23, the article’s author (historian Mike Dash) claims that this instance of “monetary terrorism” may in fact be “the most bizarre episode in all of economic history.” It arguably yielded the Western world’s first full-scale financial crisis.

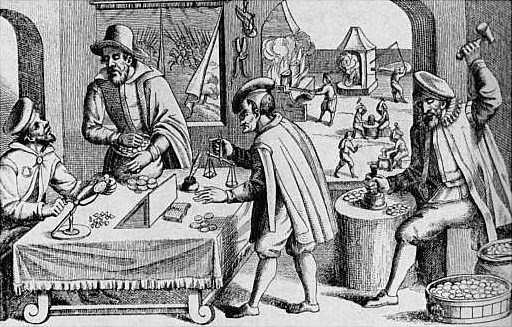

The German terms “kipper” and “wipper” derive from two nefarious practices: One is clipping coins then using the scrap to make new ones, or melting coins into a cheapened mix of precious and baser metal. The other is rigging the scales so that recipients of coinage so debased could be deceived.

And if you’re not sure what the Thirty Years’ War (1618-1648) was about, just think of it as the most destructive of the many European religious wars. Eight million casualties resulted from a Catholic vs. Protestant conflict that ballooned into a continental power struggle between the royal houses of France, Spain, the Low Countries, and some 2,000 German microstates of the fracturing Holy Roman Empire. In those German territories alone, no less than 20 percent of the population perished.

In early 17th Century Europe, the minting of coins was typically the exclusive prerogative of kings and princes, which they often delegated to their well-connected cronies in local governments, the church, or even private business. On the eve of the War, in 1617, thirty mints operated in Lower Saxony alone, according to Peter H. Wilson in “The Thirty Years War: Europe’s Tragedy.” Debasement, however, was rare—until the financial demands of the war pressed governments to find new sources of revenue. The crisis and depression spawned by the five-year hyperinflation (1618-1623) is known in German as the “kipper-und-wipperzeit.”

The Polish mathematician and astronomer Nicolaus Copernicus is universally acclaimed for his assertion that the sun was at the center of the solar system, not the earth. Less well-known are his important contributions to monetary theory, made just a century before the kipper-und-wipperzeit. If this Copernican observation had been heeded, perhaps the folly of what I’m about to tell you might have been avoided:

The greatest and most forbidding mistake has to be when a ruler tries to make a profit from the minting of coins by introducing and circulating new coins with an inferior weight and fineness, alongside the originals, and claims that they are of equal value.

The Debasement Begins

Desperate to raise cash and secure material for war, many of the German states in 1618 resorted to the debasement of coinage. They clipped and they melted. At first, they adulterated their own coin but then discovered that they could do the same to that of their neighbors too.

They would gather up as much of other states’ coins as they could, melt them down and mix in cheaper metals (most often copper), and then mint new ones that looked like the original but in fact were cheap counterfeits. Then they would send them with couriers back to the other states in the hope of passing them off on ignorant and unsuspecting citizens. The couriers would return with good coin and/or wagon loads of food and supplies.

Mike Dash noted in his Smithsonian magazine article that just about everybody got into the act:

While it lasted, the madness infected large swaths of German-speaking Europe, from the Swiss Alps to the Baltic coast, and it resulted in some surreal scenes: Bishops took over nunneries and turned them into makeshift mints, the better to pump out debased coinage; princes indulged in the tit-for-tat unleashing of hordes of crooked money-changers, who crossed into neighboring territories equipped with mobile bureau de change, bags full of dodgy money, and a roving commission to seek out gullible peasants who would swap their good money for bad. By the time it stuttered to a halt, the kipper-und-wipperzeit had undermined economies as far apart as Britain and Muscovy, and—just as in 1923 [during the infamous Weimar Republic inflation]—it was possible to tell how badly things were going from the sight of children playing in the streets with piles of worthless money

This is an opportune moment to remind readers of a crucial distinction between inflation and rising prices. They are not the same, in spite of the commonly-held sense that they are. Inflation is an increase in the money supply (and in credit as well, though credit and capital markets in the early 1600s were small and primitive by today’s standards). Rising prices are among the many deleterious effects of the inflation.

The German states first inflated the money supply by corrupting the coinage, then prices rose. Other effects of the inflation were evident too, including the destruction of savings and fixed incomes, a general economic malaise and social turmoil.

In his voluminous history, The Thirty Years War: A European Tragedy, Peter H. Wilson writes:

Good coins disappeared from circulation, while taxes were paid with debased currency. The real value of civic revenue fell by nearly 30 percent in Naumberg. Prices soared as traders demanded sackfuls of bad coins for staple commodities: the cost of a loaf of bread jumped 700 percent in Franconia beween 1619 and 1622. Those on fixed incomes suffered, like theology student Martin Botzinger whose 30 fl. annual grant became worth only three pairs of boots. Serious rioting spread from 1621, with that in Magdeburg leaving 16 dead and 200 injured.

It was all over in about five years (the inflation, not the war). Burned by the self-defeating chaos it created, the German states agreed to stop cheating and restore reasonably sound currencies. Then through taxes, requisitions and other forms of plunder, they and most of the rest of Europe waged another 25 years of bloody hostilities.

A hundred years later, France would be the scene of the Western world’s first experiment in hyperinflation using paper instead of metal. And in the two centuries since that, history records dozens of ruinous paper inflations. These episodes in monetary cheating all produced the same calamitous results no matter what form they took.

So what do men learn from history? Sometimes I think it’s little more than the fact that history is, well, interesting.

For additional reading, see:

Manias, Panics, and Crashes: A History of Financial Crises by Charles P. Kindleberger

“Finance and the Thirty Years War” by C. N. Trueman

Special Exhibit of the Deutsche Bundesbank: The German Economic Crisis of 1618-1623

“Where Have All the Monetary Cranks Gone?” by Lawrence W. Reed

“The Times That Tried Men’s Economic Souls” by Lawrence W. Reed

Lawrence W. Reed is president of the Foundation for Economic Education and author of Real Heroes: Incredible True Stories of Courage, Character, and Conviction and Excuse Me, Professor: Challenging the Myths of Progressivism. Follow on Twitter and Like on Facebook.

This article was originally published on FEE.org. Read the original article.