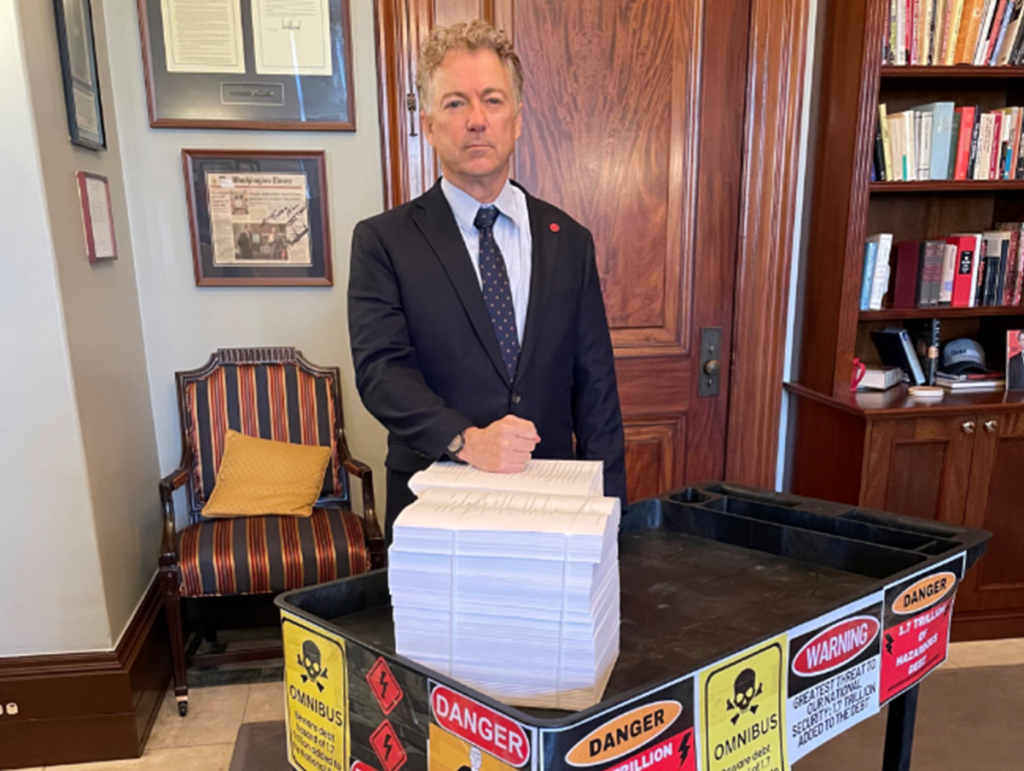

On December 20th a handful of Republican senators shuffled before an audience of reporters prepared to issue fiery polemics on the year-end omnibus bill which sat, heavy and ponderous in all its eight-ream absurdity on a wheeled cart before the five-senator assemblage.

“DANGER: $1.7 trillion of hazardous debt” read one of the mock-hazard signs decking the cart. Kentucky Senator Rand Paul declared the bill an “abomination,” while Utah Senator Mike Lee skewered the unseemly pressures to freeze it into law by proclaiming the process “legislative barbarism.”

Every year it happens with textbook repetition: Washington politicians procrastinate in releasing a colossal expense prospectus for the following year which unfailingly runs thousands of pages, requests billions of dollars, and is granted mere hours of scrutiny before being thrust to a congressional vote. The process is riddled with partisan intimidations and shrewd slandering. Democratic politicians trot out folksy pleas about supporting struggling Americans, to which, naturally, passing the bill is postured to achieve. Most Republicans cave to its smothering inevitability; a minority bitterly protest.

The omnibus bill earns its name from its practice of absorbing a collection of smaller bills into one vote. You might be tempted to call this government efficiency, but think again. In reality, it’s the gateway of legislative sloppiness and profligacy. And you might be tempted to believe Washington’s Christmas tradition is paternal benevolence for the common man but this too is a smokescreen. If our political overlords actually cared for our future in the manner of responsible stewards they would not bankrupt the nation. They would not smuggle dozens of silly congressional pet projects into our legislative initiatives. They would not make a mockery of the political process by demanding decisions on bills scarcely proffered hours of review. They would not egregiously spend money we did not have. They would not thoughtlessly shovel funds to any hungry bureaucratic mouth in the country. They would not insult American taxpayers by destroying our currency, snowballing our debt, and wrapping it all in a veneer of charity and Progress. Grim and apocalyptic though this indictment may be, it is nevertheless the bitter truth.

Desensitization

As Americans, we have become numb to the money-gobbling maneuvers of the bureaucratic machine. We hardly flinch at billion-dollar price tags, not because we do not cognitively register such a number as large but because we feel detached from its significance. We do not feel connected to its consequences. We don’t even feel particularly sure about what the spending figures should be, so bewildered by the dizzying complexity of contemporary American politics are we. We put our fingers to the glass and watch but we cannot seem to stretch our fingers out and really touch the harrowing reality of a $1.7 trillion bill or a $31 trillion in national debt. Such numbers fail to disquiet our consciences. Why?

Here are a few potential reasons.

- Nobody talks about fiscal conservatism anymore. Republicans love to rhapsodize about this fixture of their intellectual tradition but few are those who actually extend this principle from token rhetoric to the necessary scolding and refashioning efforts of current regimes. No matter whether they claim democratic or republican status, administrations do a sordid job of expenditure restraint. This equivalence between the parties is sobering indeed, indicating that the majority of republicans do not know how to defend small-government and balanced budgets with any authentic confidence. You might hear “fiscal conservatism” sprinkled throughout the campaign trail for its old-fashioned appeal and knack for attracting votes, but it is no longer practiced by those in Washington. Longtime champion of fiscal restraint Sen. Rand Paul has made entreaties for years that are drowned out by the opportunism and apathy swarming the Capitol.

- Nobody is sure why fiscal conservatism even matters: Government money has been lamentably scrubbed of morality. It bears no qualms about tempering its quantity or maintaining its quality due to an ethical contract with the people. Money has no scruples attached to it anymore. The modern conscience conceives of it as a hollow instrument; a neutral tool to get from A to B. But what is money really made of? Where does it get its value? In what ways can it be a wonderful thing and in what ways can it equally be a dangerous thing? Few care to mull these questions.

- Nobody quite feels the consequences of reckless spending yet: Because we raise debt ceilings with impunity and have thrown that old burden of balancing budgets out the window, we stay disconnected from the ramifications of fiscal hedonism. It is hard enough for politicians to make difficult choices that affect life beyond their term limits, because where’s the motivation in that? And so, money becomes this distant, untouchable relic that no one wants to poke at.

And so, not only have we lost a certain emotional reaction to government spending (i.e. an instinctual discernment of when it hits a threshold of moral questionability) but we have also lost an intellectual grasp of it (i.e. an understanding of why extravagance cannot persist in perpetuity.) All of this adds up to a mass desensitization that leaves us dangerously acclimated to an environment that pretends money is a plaything and not actually the beating heart a civilization.

Here are some of the ways in which this unlucky acclimatization has occurred:

- Money added is rarely scaled back: In government, addition is the path of least resistance. Subtraction has poor incentives, can be politically painful, and sounds mean and parsimonious to us Americans who see government as our rightful pursestrings and sympathetic caretaker.

- Added bureaucracy is rarely reviewed or pruned: More money inevitably feeds more bureaucratic cubicles. Bureaucracy is a curious animal: one that has a considerable appetite for more money and workers and administrative projects, but one that also has a deadening effect and leaves decay in its wake. In this way, bureaucracy has always bizarrely appeared to me as a life/death personification. If one thing is for sure, it will seek to justify its existence and once breathed form by taxpayer dollars, will lunge for more funds to legitimize its continuance.

- Law becomes more complex and disorienting: As sentences rain from keyboards and paper churns from the printer and more thousand-page legal monstrosities are produced, we end up building on a (new-ish) toxic American tradition of unintelligible, byzantine law. The less lucid and graspable the law is to the public, the less accountable government becomes—and the more fuzzy the political vision of the masses grows. After all, do we even know what laws were passed in the year-end omnibus bill? More worryingly still, do our politicians even know? Is this state of affairs normal? Would we call it a natural progression? I would warn against this particular temptation: the temptation to believe that increasing complexity is a sign of sophisticated progress, of governmental fine-tuning. It is not. It tangles with its serpentine requests and chokes with its punishing demands. And it throws a veneer of precision and compassion (owing to its seeming charity) over it all. As a general rule of thumb, when edicts becomes more profuse and complex and fail to remain concise and coherent to the public, they are unequivocally not serving the masses. (They are probably serving the elites.)

Post-Empire Flavor

What does one see when they gaze upon a 4,155-page bill? A symbol of American decadence. A pile of legal jargon so exhaustive its efforts look undeniably frantic. This utter excess inspires notions of blind mania. What are we doing and why? Is there any principle behind governmental motion? Are there any scraps of real thought or prudence? Or is the impetus merely zombie-like bureaucratic appetite? No matter how comprehensive and caring we would like our present government to appear, the rot cannot be fully concealed. An eight-ream bill is no sign of legislative nobility. It is an insult to the common people. It makes for a ridiculous picture of thoughtless excess. It just looks stupid at first glance. This intuitive, gut-level reaction is important. It’s the embarrassing truth of our attempts at managerial sophistry laid bare. It’s worth mentioning that empire decline is marked by an apathetic watering-down of principle, by money deterioration, and by administrative overextension. Check, check, check.

Size Matters

The larger government grows, the more money it absorbs; sure. But the less functional it becomes too. It ossifies, and its vibrant principles start to decay under the dead weight.

Once a certain threshold in size is reached (and who’s to say exactly where that is) organization lapses into oppression. Vibrancy lapses into atrophy. And decent functionality lapses into chaotic disarray. The lesson?

Overreach and you snuff out life. Congress’ proud 4,155-page creation is a post-empire emblem if there ever was one. Do not be fooled by the legislation’s size: it represents a floundering American system, not a vibrant one.

Lauren Reiff

Lauren is a writer of economics, psychology, and lots in between. To read more of her work, follow her on Medium.

This article was originally published on FEE.org. Read the original article.