Should Bitcoin’s Birth Have Been Impossible?

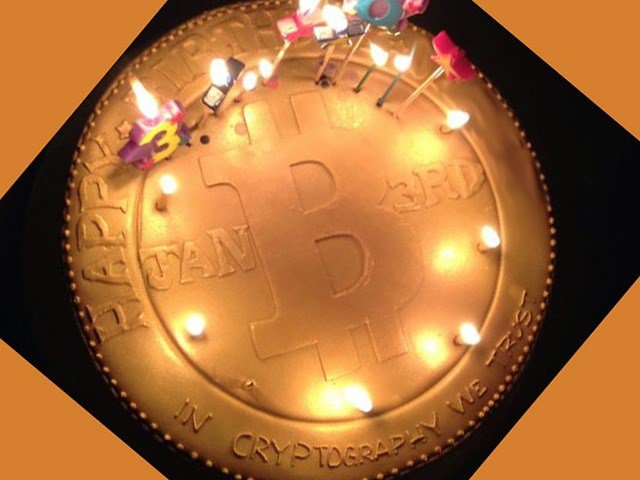

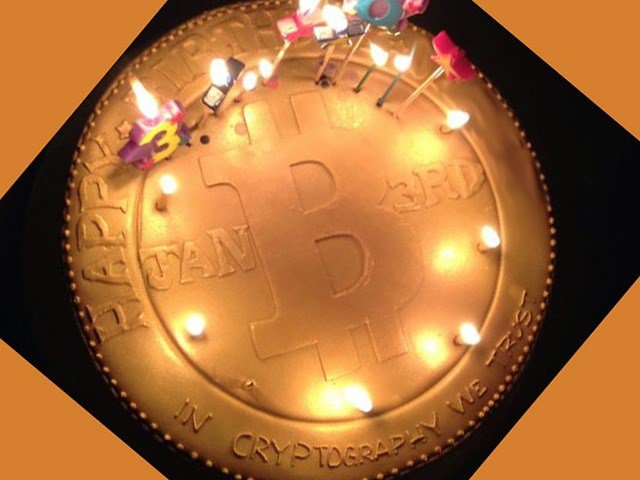

Today is Bitcoin’s 8th birthday. The digital currency’s fans can celebrate the day with extra joy (and perhaps expensive libations), since its price has run up to over $1,000.

On January 3, 2009, the first bitcoins were mined from the “Genesis block.” While that Bitcoin’s technological birth, it wasn’t born economically until some time afterward, when someone first accepted it as payment for a commodity or service. That was the origin of its value as a medium of exchange, the role that makes Bitcoin so potentially world-changing.

Some thought such a moment should have been impossible, or was at least problematic. Bitcoin was never a commodity. And according to Austrian economics as they understood it, money can only originate out of the barter of commodities.

The Origin of Money

In the 19th century, Carl Menger, the founder of Austrian economics, explained how money can arise out of barter. His theory debunked the prevailing myth that money must have originated from government decree. The market was fully capable of creating money without the help of the State.

Mises explained how a money’s value can be traced backward through time.

According to Menger, money emerges as an entrepreneurial solution to a universal problem in barter markets. It’s hard to find a seller of exactly the commodity you want who happens to want exactly the commodity you offer.

So instead of only acquiring goods he wants to use himself, a savvy merchant will build a reserve of commodities that are highly “saleable” or “liquid”: i.e., that have such a wide and steady demand, that it’s relatively easy to trade it at its full market exchange rate for just about anything he wants to buy. He accumulates these, not just to use himself, but to exchange for something else he does want to use.

As the great Austrian economist Ludwig von Mises later characterized it, such goods become extra-valuable, because they have “exchange value” on top of their “use value.” They are no longer just commodities, but “media of exchange.” When a medium of exchange becomes so popular that it’s accepted as payment by virtually everyone in the economy, it is called a “money.”

In presenting his “Regression Theorem,” Mises explained how a money’s value can be traced backward through time, all the way back to the first time it (or what it once represented) was first demanded as a medium of exchange as well as a commodity: and back still further, to when it was only demanded as a commodity.

Bitcoin and the Regression Theorem

Does the birth, existence, and continued success of Bitcoin invalidate Mises’s Regression Theorem?

No. Economic phenomena cannot invalidate economic theory, just as topographical measurements cannot invalidate geometry.

Whether Bitcoin is money or not is irrelevant.

When economic phenomena and theory seem to disagree, that can indicate the inapplicability of the theory to the given phenomenon. To return to the geometry analogy, if your measurements of a triangle don’t seem to jibe with the Pythagorean Theorem, that may be due to the fact that the shape you’re measuring is not a right triangle, but a slightly acute one.

This is what some critics of Bitcoin think is happening in this case. They say that Bitcoin is not money, and therefore not the kind of phenomenon to which the Regression Theorem refers.

That position is untenable however, because, as Mises himself stated clearly, the Regression Theorem concerns any kind of medium of exchange, and not just a universal medium of exchange (money). So whether Bitcoin is money or not is irrelevant. It is certainly used as a medium of exchange by some people, even if it is not by everybody. And so, the Regression Theorem does indeed refer to Bitcoin.

When economic phenomena and theory seem to disagree, that can also hint at the misapprehension of the phenomena in question. This is true in the same way that disagreement between triangle measurements and the Pythagorean Theorem may be due to the fact that, although the triangle being measured is a right triangle, its sides were measured incorrectly. Maybe the measurer accidentally used the inches edge of his ruler for one side, while using the centimeters edge for the other sides.

This is what some proponents of Bitcoin think is happening in this case. They say that, contrary to common perception, Bitcoin does have commodity/use value, and not just monetary/exchange value, and therefore its existence is perfectly consistent with the Regression Theorem. For example, some say that the blockchain aspect of Bitcoin has use value.

However, the issue is not whether Bitcoin has any use value at all, but whether its non-monetary use value is what first caused it to have any exchange value whatsoever. All of the proposed sources of Bitcoin use value (1) are not independent of Bitcoin’s prospective role as a medium of exchange, or (2) were not and could not have been broadly and highly valuable enough to alone give Bitcoin non-negligible liquidity.

A Matter of Theory, Not History

More fundamentally, the issue is not whether Bitcoin’s rise as a medium of exchange really was independent of commodity-use value, but whether it conceivably could have been.

Mises wrote:

“…no good can be employed for the function of a medium of exchange which at the very beginning of its use for this purpose did not have exchange value on account of other employments. (…) It must happen this way. Nobody can ever succeed in construction a hypothetical case in which things were to occur in a different way.”

Whether it happened that way or not, it’s conceivable.

However, such a hypothetical case can be made. Whether or not it actually occurred, we can hypothesize that the mysterious Satoshi Nakamoto created Bitcoin solely based on the expectation of it having future exchange value as a money. Whether or not it actually occurred, we can hypothesize that the first person who sold him something for Bitcoins did so, because Nakamoto convinced him of its money-ish qualities.

Once these assumptions are made, this gives us a medium of exchange that cannot be traced back to a commodity. Whether it happened that way or not, it is conceivable, and the hypothesis involves no inner contradictions.

This brings us to a third possible explanation for disagreement between economic theory and phenomena: perhaps the theory is indeed imperfect.

Yet, any imperfection in an economic theory can only be due to imperfect reasoning. Imperfect reasoning can lead to disagreement between theory and phenomena. And therefore, disagreeing phenomena may be a hint that the theory was constructed with imperfect reasoning. But disagreeing phenomena alone does not invalidate the theory. It only gives the theorist a prompt to check his reasoning. It is then the discovery of imperfect reasoning alone that can invalidate an economic theorem.

Similarly, if a geometry student thought that, for a right triangle, the sum of the squares of the legs equaled the cube (and not the square) of the hypotenuse, even that false theorem could not be invalidated by inconsistent measurements. Such measurements can only prompt the geometry student to seek out the faults in his reasoning that produced a fallacious theorem. Only the identification of those faults can actually invalidate the theorem.

Check Your Premises

So, the existence of Bitcoin does not, and could never, invalidate the Regression Theorem, or any other economic theorem (the Law of Demand, the Law of Comparative Advantage, etc.). It can, however, prompt us to check our reasoning.

The essential core of the Regression Theorem is completely true and indispensable to economic theory.

And by thinking through it, we can realize that it is perfectly conceivable that a digital, cryptographic “coin” could be used as a medium of exchange for the first time without ever being a commodity. It is perfectly conceivable that such a coin could be demanded based on forecasted exchange value alone.

Furthermore, it is not true that, as some have claimed, a record of past valuations had to exist as reference points in order for future exchange value to be forecasted. It is perfectly conceivable that the first person who traded a pizza for Bitcoin, for example, had some vague notion that Bitcoin might some day become a valuable monetary unit, just based on, say, Nakamoto’s arguments to that effect.

So does pure reasoning (which may happen to be prompted by the existence of Bitcoin) invalidate the Regression Theorem?

No. It does modify it. But the essential core of the Regression Theorem is completely true and indispensable to economic theory. Some proponents of Bitcoin think otherwise, but only because of a common misunderstanding of what the essence of the Regression Theorem is.

The Main Contribution

Most fans of Austrian economics put too much emphasis on how the regression in Mises’s theorem terminates (how it traces back to a commodity). But that is not what makes the Regression Theorem such an important advance for economics. After all, it is not called the Regression Terminus Theorem. The key element of the theorem is not the regression’s terminus, but the regression itself.

Mises explained in Human Action that:

…the demand for a medium of exchange is the composite of two partial demands: the demand displayed by the intention to use it in consumption and production and that displayed by the intention to use it as a medium of exchange. With regard to modern metallic money one speaks of the industrial demand and of the monetary demand. The value in exchange (purchasing power) of a medium of exchange is the resultant of the cumulative effect of both partial demands.

Now the extent of that part of the demand for a medium of exchange which is displayed on account of its service as a medium of exchange depends on its value in exchange. This fact raises difficulties which many economists considered insoluble so that they abstained from following farther along this line of reasoning. It is illogical, they said, to explain the purchasing power of money by reference to the demand for money, and the demand for money by reference to its purchasing power.

Put briefly, the problem boils down to the seemingly circular logic of saying that, “value comes from utility, which comes from value.”

This problem of circularity is why, before Mises’s great contribution in his 1912 Theory of Money and Credit, many theorists criticized the marginal utility theory of value (and the subjectivist economics that was based on it) as being discredited by its seemingly problematic application to money. Mises’s great contribution was to vindicate the subjectivist economics by breaking out of this circle with his regression. As Mises continued:

The difficulty is, however, merely apparent. The purchasing power which we explain by referring to the extent of specific demand is not the same purchasing power the height of which determines this specific demand. The problem is to conceive the determination of the purchasing power of the immediate future, of the impending moment. For the solution of this problem we refer to the purchasing power of the immediate past, of the moment just passed. These are two distinct magnitudes. It is erroneous to object to our theorem, which may be called the regression theorem, that it moves in a vicious circle.

The evolution of any widely-used medium of exchange simply cannot be understood without the “temporal regression” essence of Mises’s Regression Theorem. Again, it is absolutely essential for sound, subjective-value-based economic theory.

Mises’s addition of the “commodity terminus” to the Regression Theorem was merely a matter of tying up a loose end:

But, say the critics, this is tantamount to merely pushing back the problem. For now one must still explain the determination of yesterday’s purchasing power. If one explains this in the same way by referring to the purchasing power of the day before yesterday and so on, one slips into a regressus in infinitum. This reasoning, they assert, is certainly not a complete and logically satisfactory solution of the problem involved. What these critics fail to see is that the regression does not go back endlessly. It reaches a point at which the explanation is completed and no further question remains unanswered. If we trace the purchasing power of money back step by step, we finally arrive at the point at which the service of the good concerned as a medium of exchange begins. At this point yesterday’s exchange value is exclusively determined by the nonmonetary — industrial — demand which is displayed only by those who want to use this good for other employments than that of a medium of exchange.

This “commodity terminus” is perfectly conceivable and extremely likely in nearly all cases. But again, it is not the only conceivable starting point. Another conceivable beginning, especially in a world in which money is already a well-known phenomenon, is the initial instance of exchange value being entirely determined by monetary demand based purely on “hunch”-based forecasts of future purchasing power. Once a record of purchasing power is established, past purchasing power must be taken into account when explaining present purchasing power. But there needn’t necessarily be such a record for the first flickering of purchasing power to occur.

Ludwig von Mises’s Regression Theorem was one of the most brilliant and crucial advances in the history of monetary economics. It is only its merely-auxiliary proposition concerning how the regression must end that should be modified in light of the conceivability of digital cryptocurrencies.

The Regression Theorem’s essential proposition stands as indispensable and as unassailably true today as it was in 1912, and as it will be in the year 3012.

Dan Sanchez is Managing Editor of FEE.org. His writings are collected at DanSanchez.me.

This article was originally published on FEE.org. Read the original article.

What Is the Blockchain and What Can It Do? Interview with Caitlin Long

What Is the Blockchain and What Can It Do? Interview with Caitlin Long